Measures for Verification Collection of Enterprise Income Tax (for Trial Implementation)

Notice of the State Administration of Taxation on Printing and Distributing the Measures for Verification Collection of Enterprise Income Tax (for Trial Implementation)

No. 30 [2008] of the State Administration of Taxation

Offices of the State Administration of Taxation and local taxation bureaus in all provinces, autonomous regions, municipalities directly under the Central Government and cities under separate state planning,

The Measures for Verification Collection of Enterprise Income Tax (for Trial Implementation), which were formulated by the State Administration of Taxation for the purpose of strengthening the verification collection of enterprise income tax, are hereby printed and distributed to you, please comply with them accordingly.

1. The determination of the manner of the collection of enterprise income tax shall be in strict accordance with the prescribed scope and criterions. The scope of verification collection of enterprise income tax should not be expanded illegally. It is strictly forbidden to uniformly adopt the manner of verification collection of enterprise income tax by referring to the industries or scale of enterprises.

2. The enterprise income tax shall be verified and collected under the principle of fairness, impartiality and openness. The payable amount of income tax or taxable income rate for each taxpayer in each industry should be verified on the basis of the taxpayerís production and business operation features as well as comprehensive consideration of the enterpriseís geographical place, business scale, income level, profit level and other factors so as to ensure approximate income tax burden on the same type of or similar enterprises with approximate scale in the same area.

3. You should offer good services in the verification collection of enterprise income tax. The arrangements for verification collection of enterprise income tax should be convenient to the taxpayers and be consistent with the taxpayers?actual circumstances. The verification and determination tasks should be finished within the prescribed time limit.

4. The task of taxpayers?establishment of accounts and bylaws shall be pushed forward. The tax organs should actively urge the taxpayers, who are subject to verification collection of enterprise income tax, to establish accounts and bylaws and improve their business management, and should guide them to transit to the manner of audit collection. For taxpayers who meet the conditions for the manner of audit collection, it should timely adjust the manner of collection of enterprise income tax and adopt the manner of audit collection.

5. The inspection of taxpayers subject to verification collection of enterprise income tax shall be strengthened. It should enhance the inspection of taxpayers subject to verification collection of enterprise income tax by combining the audit of the final settlement and tax payments and check of routine taxation administration, reasonably determine the range of annual audit so as to prevent taxpayers from intentionally decreasing the tax burden through the manner of verification collection of enterprise income tax.

6. The offices of State Administration of Taxation and local taxation bureaus should closely cooperate with each other. You should jointly carry out the task of verification collection of enterprise income tax, jointly determine the taxable income rates for different industries and jointly discuss and determine the payable income tax amounts for different taxpayers so as to realize that the taxpayers, which are under the jurisdiction of an office of the State Administration of Taxation or local taxation bureau and almost identical to each other in such aspects as production and business place, business scale and business scope, are subject to nearly the same payable income tax amounts and taxable income rates upon verification.

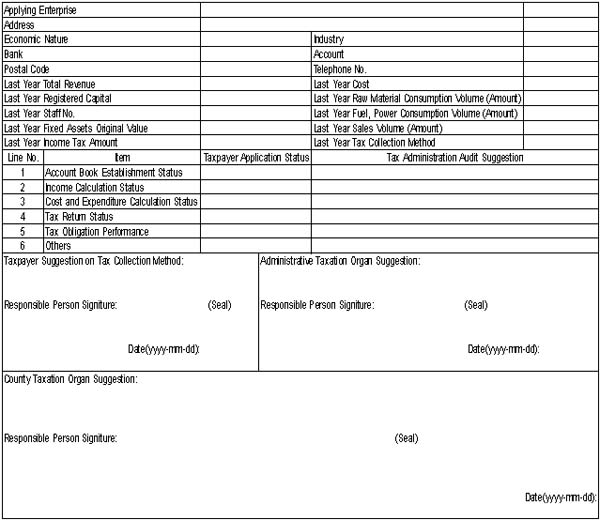

Annex: Appraisal Table of Verification Collection of Enterprise Income Tax

The State Administration of Taxation

March 6, 2008

Measures for Verification Collection of Enterprise Income Tax (for Trial Implementation)

Article 1

With a view to strengthening the administration of collection of enterprise income tax, regulating the verification collection of enterprise income tax, ensuring the timeliness and full amount of state revenue and maintaining the taxpayers?legitimate rights and interests, these Measures are formulated in accordance with the Enterprise Income Tax Law of the P.R.C., the Regulation on the Implementation of Enterprise Income Tax Law of P.R.C., the Law of P.R.C. on the Administration of Tax Collection as well as its Detailed Rules.

Article 2

These Measures shall apply to taxpayers as resident enterprises.

Article 3

Where a taxpayer is under any of the following circumstances, it shall be subject to verification collection of enterprise income tax:

(1) It is not required to establish account books under relevant laws and administrative regulations;

(2) It should establish account books under relevant laws and administrative regulations but hasnít done so;

(3) It illegally destroys the account books or refuses to provide tax paying references; 

(4) It has established account books but it is difficult to make an audit because the accounts are in disorder or the cost references, income vouchers and expenditure vouchers are incomplete;

(5) It fails to file a tax return for a tax obligation within the prescribed time limit and refuses to file a tax return even after the tax organ orders it to do so within a time limit;

(6) It reports an obviously low tax basis without any justifiable reason. 

Taxpayers of special industries or special types and those with a certain scale are not governed by these Measures. The foregoing taxpayers shall be separately clarified by the State Administration of Taxation.

Article 4

The tax organ shall, on the basis of the specific circumstance of a taxpayer subject to verification collection of enterprise income tax, verify its taxable income rate or payable amount of income tax.

Where a taxpayer is under any of the circumstances, its taxable income rate shall be verified:

(1) The total income can be calculated (verified) correctly, but its total cost is unable to be correctly calculated (verified);

(2) Its total cost can be calculated (verified) correctly, but its total income is unable to be correctly calculated (verified);

(3) Its total income or total cost can be calculated and inferred through reasonable approaches.

Where a taxpayer is not under any of the above circumstances, its payable amount of income tax shall be verified.

Article 5

The tax organ can verify the enterprise income tax to be collected through the following approaches:

(1) Verify by referring to the tax burden on local taxpayers in the same or similar industry and with approximate business scale and income level;

(2) Verify by referring to the amount of taxable income or the amount of costs and expenses;

(3) Verification based on calculation and inference or measurement of the consumed raw materials, fuel, energy, etc.;

(4) Verification through other reasonable approaches.

If it is insufficient to employ one of the approaches as listed in the preceding paragraph to correctly verify the taxable income amount or payable tax amount, two or more approaches may be adopted. If there is any discrepancy between the results concluded through two or more approaches, the highest payable tax amount calculated shall prevail.

Article 6

If the enterprise income tax to be collected is verified through the manner taxable income rate, the formula or calculation of the payable income tax amount is as follows:

The payable income tax amount=the taxable income amount◊the applicable tax rate

The payable income tax amount=the taxable income amount◊the taxable income rate

Or: the payable income tax amount=the cost (expenditure) amount/(1-taxable income rate)◊taxable income rate

Article 7

The applicable taxable income rate of taxpayers that is subject to verification collection enterprise income tax through the manner of taxable income rate will be clarified by taxation organ based on its main business, no matter whether the business is calculated separately from other businesses.

The main business should have the largest portion of total revenue, or cost (expenditure), or consumed raw material, fuel, power among all taxpayer businesses.

Article 8

Taxable income rates should be clarified according to the following prescribed ranges:

|

Industry

|

Taxable Income Rate(%)

|

|

Agriculture, forestry, livestock, fishery

|

3-10

|

|

Manufacturing

|

5-15

|

|

Wholesale and retail trade

|

4-15

|

|

Transportation

|

7-15

|

|

Construction

|

8-20

|

|

Restaurant

|

8-25

|

|

Entertainment

|

15-30

|

|

Other industries

|

10-30

|

Article 9

If production and business scope, main business of taxpayer have major change, or increase or decrease of taxable income rate reaches 20%, the taxpayer should apply to taxation organ for adjustment of the fixed payable tax amount or taxable income rate.

Article 10

Administrative taxation organ should send Appraisal Table of Verification Collection of Enterprise Income Tax (see attachment) to taxpayer and finish appraisal of verification collection of enterprise income tax in time. Detail procedure is as follows:

(1) Taxpayer should fill up the form and submit it to administrative tax organ within 10 days after receiving the Appraisal Table of Verification Collection of Enterprise Income Tax. The Appraisal Table of Verification Collection of Enterprise Income Tax has three pages, with two pages kept by administrative taxation organ and county taxation organ respectively and the other sent to taxpayer for implementation. If itís necessary, administrative taxation organ can add pages for backup.

(2) Administrative taxation organ should verify enterprises one by one according to different category, put forward appraisal suggestions and submit it to county taxation organ for audit and recognition within 20 working days after handling Appraisal Table of Verification Collection of Enterprise Income Tax.

(3) County taxation organ should finish audit and recognition within 30 working days after receiving Appraisal Table of Verification Collection of Enterprise Income Tax.

Taxation organ will regard taxpayer, who has received Appraisal Table of Verification Collection of Enterprise Income Tax but hasnít filled up or submitted it within a certain time limit, as having submitted it and will audit and recognize according to the above procedure.

Article 11

Taxation organ should conduct appraisal again by the end of June each year targeting at taxpayers that are subject to verification collection of enterprise income tax in the previous year. Before the appraisal is finished, taxpayer can prepay enterprise income tax by temporarily referring to verification collection approach of the previous year; the tax amount can be adjusted according to the appraisal result when itís finished.

Article 12

Administrative taxation organ should publicize verified payable income tax amount or taxable income rate for each enterprise by different categories. Administrative taxation organ should confirm the place and approach of publicity under the principle of easy to be known and supervised by tax payers and all walks of life.

If taxpayers have different opinions towards enterprise income tax collection approach, payable income tax amount or taxable income rate confirmed by taxation organ, they should provide legal and effective evidence. Taxation organ will adjust the disagreed item after verification and recognition.

Article 13

Taxpayers, who are subject to verification of taxable income rate, should observe the following prescription for tax declaration:

(1) Administrative taxation organ should decide whether taxpayers need to prepay on monthly or quarterly basis and year end settlement according to the size of tax amount. Once the prepayment method is confirmed, it canít be changed within one taxation year.

(2) Taxpayer should prepay the actual payable tax amount based on calculation of confirmed taxable income rate. If some enterprise can hardly afford full amount of prepayment, they can prepay 1/12 or 1/4 payable tax amount of last year after being approved by administrative taxation organ, or execute other prepayment approach recognized by administrative taxation organ.

(3) Taxpayer should fill up Enterprise Income Tax Monthly (Quarterly) Prepayment Declaration Form (B Class) of P.R.C. during prepayment or year end settlement and submit it to administrative taxation organ.

Article 14

Taxpayers, who are subject to verification of payable income tax amount, should observe the following prescription for tax declaration:

(1) Before payable income tax amount is confirmed, taxpayer can temporarily prepay 1/12 or 1/4 payable income tax amount of last year, or prepay on monthly or quarterly basis recognized by administrative taxation organ.

(2) After the payable income tax is confirmed, it should deduct the already prepaid income tax amount and divide the balance into each month or quarter. When the monthly or quarterly payable tax amount is confirmed, taxpayers should fill up Enterprise Income Tax Monthly (Quarterly) Prepayment Declaration Form (B Class) of P.R.C. and declare tax within prescribed time limit.

(3) After year end settlement, taxpayers should declare tax according to actual business revenue or payable tax amount to taxation organ within prescribed time limit. If the declared tax amount exceeds verified business revenue or payable tax amount, the declared amount should be collected; if the declared tax amount is lower than verified business revenue or payable tax amount, the verified business revenue or payable tax amount should be collected. 

Article 15

Any behavior that violated these Measures will be subject to the prescription of Law of the P.R.C. Concerning the Administration of Tax Collection as well as its Implementation Details.

Article 16

Offices of the State Administration of Taxation and Local Taxation Bureau in each province, autonomous region, municipalities directly under the Central Government and cities under separate state planning should jointly formulate concrete implementation method based on these Measures and submit it to the State Administration of Taxation for filing.

Article 17

These Measures take effect on Jan.1, 2008. Meanwhile, Notice of the State Administration of Taxation on Printing and Distributing the Interim Measures for Verification Collection of Enterprise Income Tax (No. 38 [2000] of the State Administration of Taxation) is abolished.

Annex:

|